Would you keep your savings in dollars or pesos if you are living in DR? Te returns for CDs are much higher in pesos but I'm not sure how risky could be. Any thoughts?

- Thread starter Lola Mento

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dollars US$ vs pesos RD$ savingS

If you can, keep your money in a bank in your home country and get the money you need for living expenses by use of ATMs and/or cashing checks on your home-bank account with a friendly casa a de campo. I do the latter, as do others on this message board.

It is good to have a small amount for emergency use here, but you are better off with your money in a bank in your home country.

Right now things seem to be pretty stable, but this is not always the case. Also, you don't get government protection on the money in the bank like I get in the US. During the years I've lived here, several times I lost what was in the bank when it went out of business. Again, that may be less likely now, but still it is something to think about.

If you buy peso CDs, think of it like any other investment and buy only what you can afford to lose if something happens.

It is good to have a small amount for emergency use here, but you are better off with your money in a bank in your home country.

Right now things seem to be pretty stable, but this is not always the case. Also, you don't get government protection on the money in the bank like I get in the US. During the years I've lived here, several times I lost what was in the bank when it went out of business. Again, that may be less likely now, but still it is something to think about.

If you buy peso CDs, think of it like any other investment and buy only what you can afford to lose if something happens.

What do you mean I can lose my money by investing it in a CD, how can this happen?. I understand I may lose if I invest in the stock market. I'm inexperienced but my understanding was that investing in a CD has low returns due to the low risks it involves. I'm planning to move permanently to DR and for business porpouses it will not be convenient to rely on ATMs.

What do you mean I can lose my money by investing it in a CD, how can this happen?. I understand I may lose if I invest in the stock market. I'm inexperienced but my understanding was that investing in a CD has low returns due to the low risks it involves. I'm planning to move permanently to DR and for business porpouses it will not be convenient to rely on ATMs.

So keep your dough in a US bank that is FDIC insured, and move a few grand at a time, or cash a check at any reputable cambio. A Dominican CD is not insured against currency risk or default, GOOGLE Baninter for a wake up call bro.

Please try the search function, there is endless info on personal finance. I do not live in RD, but spend 4-6 weeks at a time and have never had a problem getting my dough out of a US bank via an ATH.

Are you going into the fishin' bidness with porpoises. Tambo'

.I live here and get all my pesos by cashing checks at a casa de campo. I may not need as much as you, but I regularly write checks for US$500, $1000, or whatever I need for a particular purpose. Nothing inconvenient about that. Just a matter of going to my banco de cambio, give them a check and take my money.

Those advices were valid in the years following 2003, but after 7 years I think they are losing steam. I really believe that while the Central Bank is controlled by Albizu your CD deposits will be really safe, no drastic exchange rates changes or worse losing all your money because is not "insured" (please ask who lost any money in the 2003 3 banks debacle, give me a break).

Those advices were valid in the years following 2003, but after 7 years I think they are losing steam. I really believe that while the Central Bank is controlled by Albizu your CD deposits will be really safe, no drastic exchange rates changes or worse losing all your money because is not "insured" (please ask who lost any money in the 2003 3 banks debacle, give me a break).

Yes, I think the government now takes more responsibility to protect depositors than it did in the past, recognizing that the banking industry in this country was getting a very bad reputation internationally, but is money on deposit or in cds as safe here as in an insured bank in the US? I don't think so.

It is safe for what I have read

I read a couple of articles mainly about the banking system in the DR and the Baninter case and the colonclusion was the following.

In the Dominican Republic there are numerous banking institutions, all of which are backed by the central bank:

Banco Popular*

Banco De Reservas*

Banco Leon*

Banco Del Progresso*

Banco Santa Cruz*

Banco BHD*

Scotiabank*

Citibank

Moreover the system works since Not one depositor lost money in the latest government takeover (2002 - 2003) of Banco Intercontinental. So I think ExtremeR is right about the safety.

I read a couple of articles mainly about the banking system in the DR and the Baninter case and the colonclusion was the following.

In the Dominican Republic there are numerous banking institutions, all of which are backed by the central bank:

Banco Popular*

Banco De Reservas*

Banco Leon*

Banco Del Progresso*

Banco Santa Cruz*

Banco BHD*

Scotiabank*

Citibank

Moreover the system works since Not one depositor lost money in the latest government takeover (2002 - 2003) of Banco Intercontinental. So I think ExtremeR is right about the safety.

I read a couple of articles mainly about the banking system in the DR and the Baninter case and the colonclusion was the following.

In the Dominican Republic there are numerous banking institutions, all of which are backed by the central bank:

Banco Popular*

Banco De Reservas*

Banco Leon*

Banco Del Progresso*

Banco Santa Cruz*

Banco BHD*

Scotiabank*

Citibank

Moreover the system works since Not one depositor lost money in the latest government takeover (2002 - 2003) of Banco Intercontinental. So I think ExtremeR is right about the safety.

You asked for opinions and you got them. But it is your money; so you have to make the decision.

Would you keep your savings in dollars or pesos if you are living in DR? Te returns for CDs are much higher in pesos but I'm not sure how risky could be. Any thoughts?

US Dollars in a US account!

Is that better Shalena?

@ken2, you are absolutely right about the fact that at the end I will have to make the decision and I did. @shalena, thank you  straight foward.

straight foward.

The rest of you thank you for taking the time to let me know your opinion. Very helpful.

The rest of you thank you for taking the time to let me know your opinion. Very helpful.

US Dollars in a US account!

Is that better Shalena?

Luv ya, muah!

SHALENA

Actually her or his original question was would you have your savings in pesos or dollars in DR. Nobody actually answered it.

SHALENA

P.S. Dollars

US Dollars in a US account!

Is that better Shalena?

I did mine is pesos, but then, the interest was 16%, and even with inflation I figured I would stay ahead of the game.

Instead of cashing US dollars for the last three years, I used the interest for some of it. When the CD's expire, I can use the principle and in effect be changing the pesos back to dollars.

But that was then and not now!

so, what would be your ideas of investing here in DR in order to get best return on my money?

SHORT US Treasury Futures,

BUY Crude Oil on any pullback.

Personally I do not think an investment in RD Pesos is worth the risk right now @ these rates.

Take a look at buying RD Real Estate at a deep discount.

***These are just personal opinions, and not a reco to BUY/SELL any securities here or there!

E

engineerfg

Guest

Opinions are like A-Holes, everyone's got one, so here's my opinion:

1. Many people on this board are confusing 'savings' with 'investments'. The question you're asking is how you should store your savings. In my mind, the root word for savings is 'safety'. As in - don't risk your savings, keep it safe.

I'm perfectly happy keeping my savings in a low return, super safe, bank in a mixture of USD and EUR in a low tax jurisdiction. I don't care if it doesn't 'perform' as well as it could - it's my savings, not my investments.

2. I allocate a portion of my savings (decreasing each year), to be investment worthy. And invest that to suit my own risk profile.

3. If you're contemplating putting your money in CD's here or Tbills there etc, think about the big picture, what are you really trying to do? make an investment? or keep your savings safe?

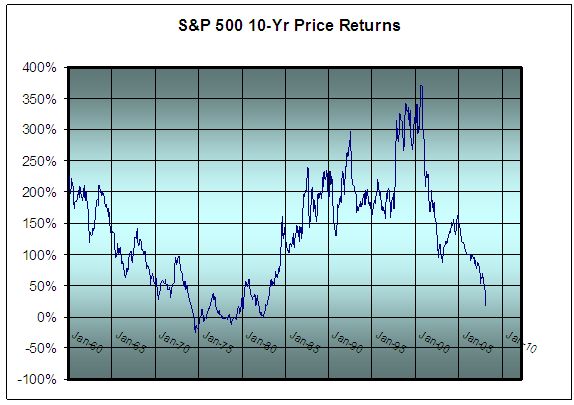

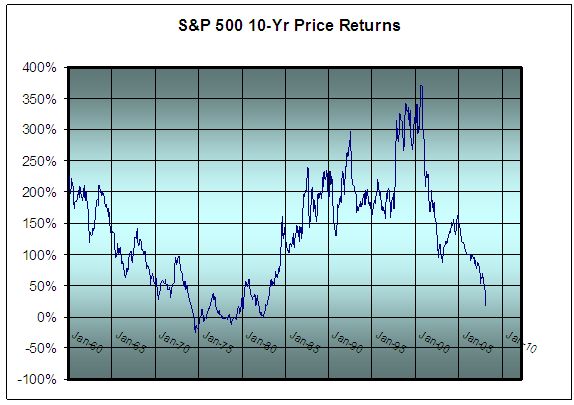

4. Also don't forget that the S&P 500 - return over the past 10 years has been...0%. So simply beating taxation, you're 'ahead' of the market...

http://static.seekingalpha.com/uploads/2008/3/16/spy.jpg

To each his own...

1. Many people on this board are confusing 'savings' with 'investments'. The question you're asking is how you should store your savings. In my mind, the root word for savings is 'safety'. As in - don't risk your savings, keep it safe.

I'm perfectly happy keeping my savings in a low return, super safe, bank in a mixture of USD and EUR in a low tax jurisdiction. I don't care if it doesn't 'perform' as well as it could - it's my savings, not my investments.

2. I allocate a portion of my savings (decreasing each year), to be investment worthy. And invest that to suit my own risk profile.

3. If you're contemplating putting your money in CD's here or Tbills there etc, think about the big picture, what are you really trying to do? make an investment? or keep your savings safe?

4. Also don't forget that the S&P 500 - return over the past 10 years has been...0%. So simply beating taxation, you're 'ahead' of the market...

http://static.seekingalpha.com/uploads/2008/3/16/spy.jpg

To each his own...

The trend for the $DR/$US has been pretty consistant for about three years. Not in any freefall but not good compare to the $US. For the longest time it was between 32-34 to the $US and now it's about 37.

Dominican Peso: CURRENCY OPUSD quotes & news - Google Finance

OPUSD quotes & news - Google Finance

Dominican Peso: CURRENCY

E

engineerfg

Guest

True. But if you're holding under $100K of funds in the US, or many other countries, and the bank gets wiped out, or is a victim of any force majeur, the government guarantees your deposits. How does that work in this country?

if you want real information about whether have your money in US$ or DS$ then don't use US webpages or americans to get your information from, that's just brainwashed information. Your money in the RD is safe, safer than in the US and your money is not insured in the US at all. about 1% of the whole assets in the US are insured, so if there is a crash everyone get's 1%. I wouldn't call this an insurance. The US keeps printing dollars and that's why the US$ is going to crash some time soon. Russia and China are already presenting examples for the new world currency and it is just a matter of time till the world will switch because the US$ isn't worth anything anymore because of the US economy and them just printing more and more.

If you want your money to be safe and not to loose 50% or more within the next 10 years then keep it outside of the US in an currency other than the US$. the dominican republic is a stable country at the moment but nobody can tell what will happen here in the next 20 years. it might that the country will boom or that the corruption and the drugs take over like in mexico. As a matter of fact the US are bankrupt and the DR is doing well at the moment. Would you leave your money in a bankrupt country where only 1% of it is insured? Doesn't take rocket science to figure that out.

If you want your money to be safe and not to loose 50% or more within the next 10 years then keep it outside of the US in an currency other than the US$. the dominican republic is a stable country at the moment but nobody can tell what will happen here in the next 20 years. it might that the country will boom or that the corruption and the drugs take over like in mexico. As a matter of fact the US are bankrupt and the DR is doing well at the moment. Would you leave your money in a bankrupt country where only 1% of it is insured? Doesn't take rocket science to figure that out.