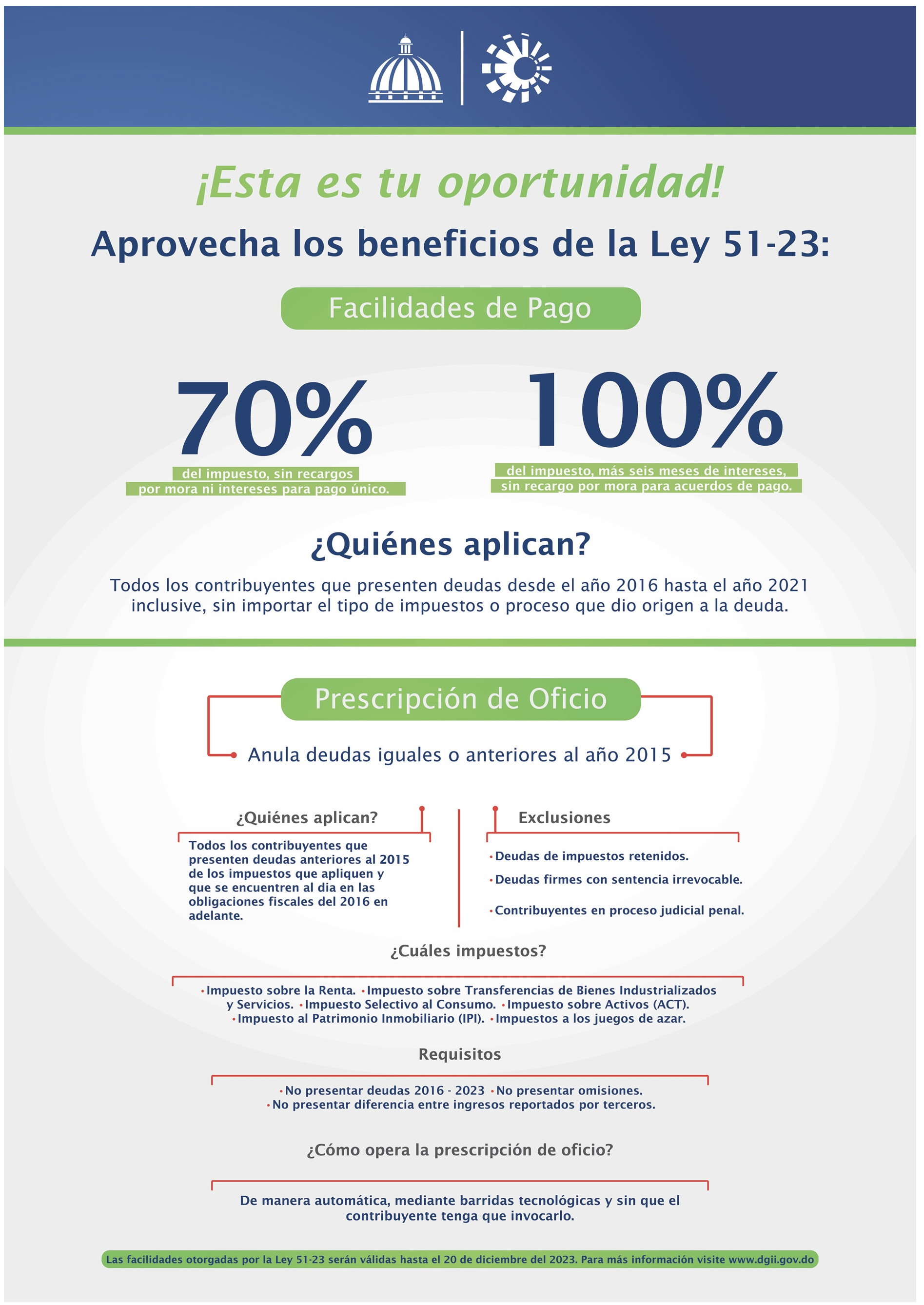

In today's Listín Diario is a full page advertisement from the Dominican government and the DGII regarding people in arrears with the taxes they owe. The new Law 53-23 allows to take advantage of the following (if qualify).

(I) PAY OPTIONS

- Pay 70% of the taxes owed with no interest nor late fees.

- Pay 100% of taxes owed, plus six months interests but no late fees.

Who can apply?

All tax payers who owe taxes from 2016 to 2021 (regardless of the type of tax(es) or how the debt originated),

-------

(II) PRESCRIPCION DE OFICIOS

Annuls all tax debt from 2015 and prior.

Who can apply?

All with outstanding tax debt up to 2015 and are on time with taxes from 2016 and onward.

Exclusions

- Debts of retained taxes.

- Firm debts with an irrevocable court sentence.

- Tax debters currently in a judicial process.

Which taxes?

- Income Tax

- Industrial Goods & Services Transfer Tax

- Selective Consumption Tax

- Assets Tax

- Real Estate Tax

- Gambling Tax

Requirements

- Not have outstanding tax debts from 2016 to 2023.

- No omissions.

- No difference with reported income by third parties.

How does the Prescripción de oficios works?

- Automatically

- Technological elimination

- Tax payer doesn't have to invoke it.

This amnesty is valid until December 20, 2023. More info at www.DGII.gov.do.*

* Notice the web address is a .gov and not .gob.

(I) PAY OPTIONS

- Pay 70% of the taxes owed with no interest nor late fees.

- Pay 100% of taxes owed, plus six months interests but no late fees.

Who can apply?

All tax payers who owe taxes from 2016 to 2021 (regardless of the type of tax(es) or how the debt originated),

-------

(II) PRESCRIPCION DE OFICIOS

Annuls all tax debt from 2015 and prior.

Who can apply?

All with outstanding tax debt up to 2015 and are on time with taxes from 2016 and onward.

Exclusions

- Debts of retained taxes.

- Firm debts with an irrevocable court sentence.

- Tax debters currently in a judicial process.

Which taxes?

- Income Tax

- Industrial Goods & Services Transfer Tax

- Selective Consumption Tax

- Assets Tax

- Real Estate Tax

- Gambling Tax

Requirements

- Not have outstanding tax debts from 2016 to 2023.

- No omissions.

- No difference with reported income by third parties.

How does the Prescripción de oficios works?

- Automatically

- Technological elimination

- Tax payer doesn't have to invoke it.

This amnesty is valid until December 20, 2023. More info at www.DGII.gov.do.*

* Notice the web address is a .gov and not .gob.