It should be noted and even I didn't know this until the interview in the previous post, Promerica is actually a Nicaraguan bank. I thought it was from some other country (never in a million years would Nicaragua makes it to that radar), an original Dominican invention or a subsidiary of a US bank or something like PriceSmart which has no presence in the US but the founders and most or all of the top people are Americans.

While there isn't much in the DR from Nicaragua, usually it isn't a company or brand marketed to consumers such as a bank. For example, not many people know that the main owner of the Acrópolis highrise and mall in SD is Nicaraguan (a woman too, a further rarity among big investors), the same with the holder of the TGI Friday franchise in the DR. Like that there are a few more things that exist in the DR, but it's somewhat hidden that the owner(s) are Nicaraguan.

It turns out that Promerica is called Banpro in Nicaragua, it was founded in 1991 (another shocker to me, very young bank) and is the largest private bank in Nicaragua.

Promerica has been in the DR since the year 2000. They became a commercial bank in the DR in 2013.

Shares of the bank per assets in the country they are in vis-a-vis the other major banks in each country. They are the fifth largest bsnk by assets in the DR.

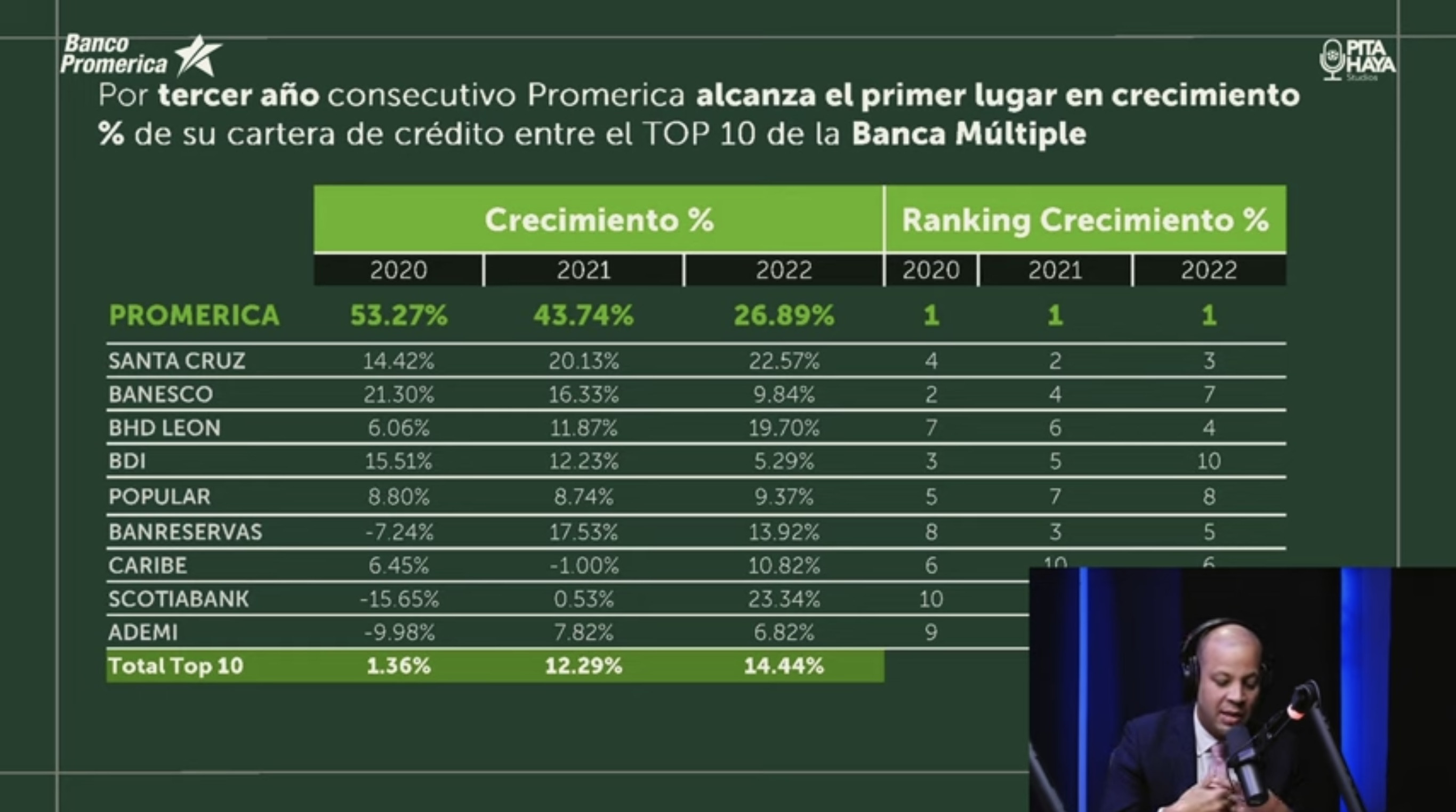

This one is another shocker. Of all the major banks in the DR, they have the most growth of its credit portfolio (loans.)

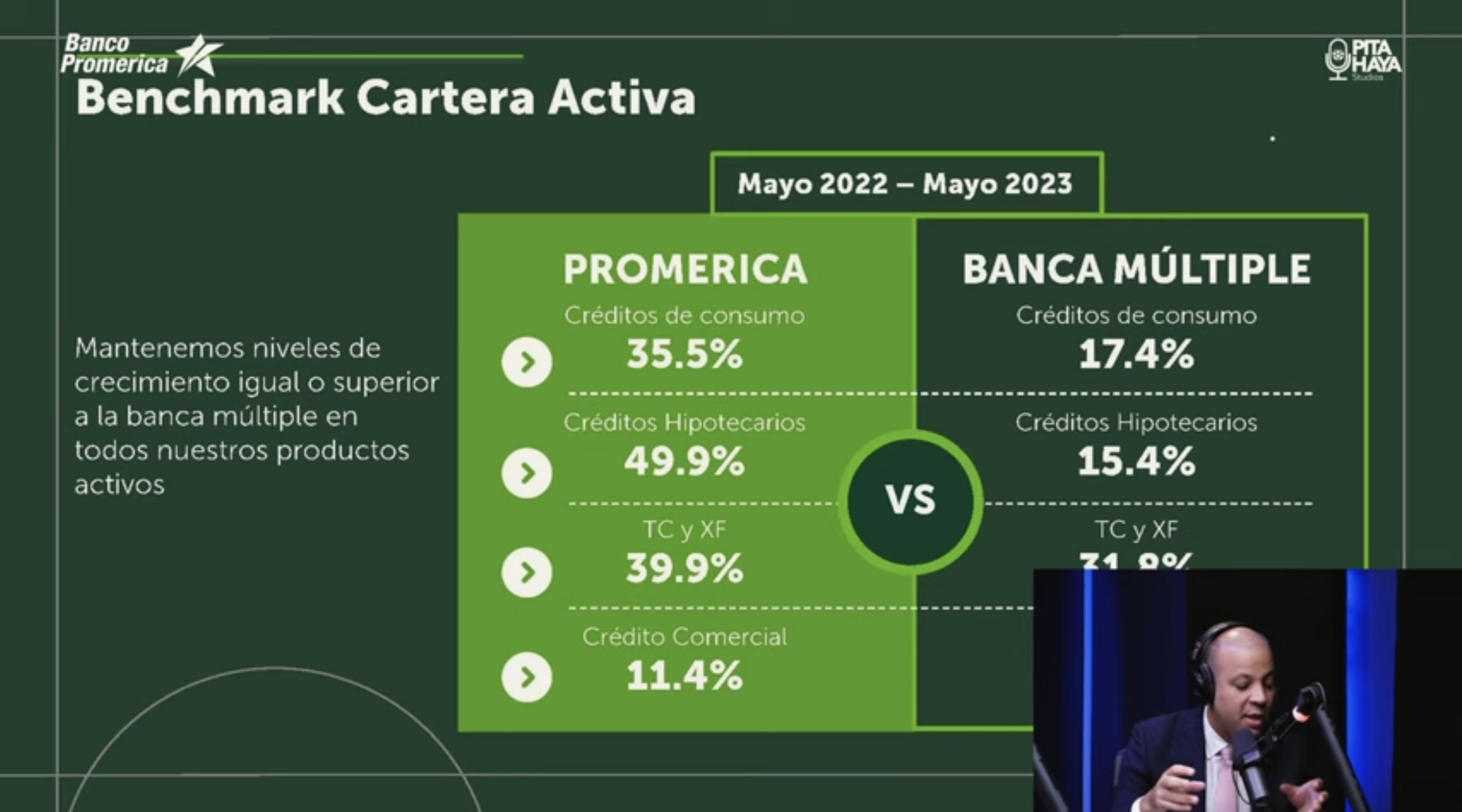

Another shocker, they outperform in growth for the Dominican sector for consumer credit (especially credit cards), mortgages, TC & XF, and commercial credit during the May 2022 - 2023 period.

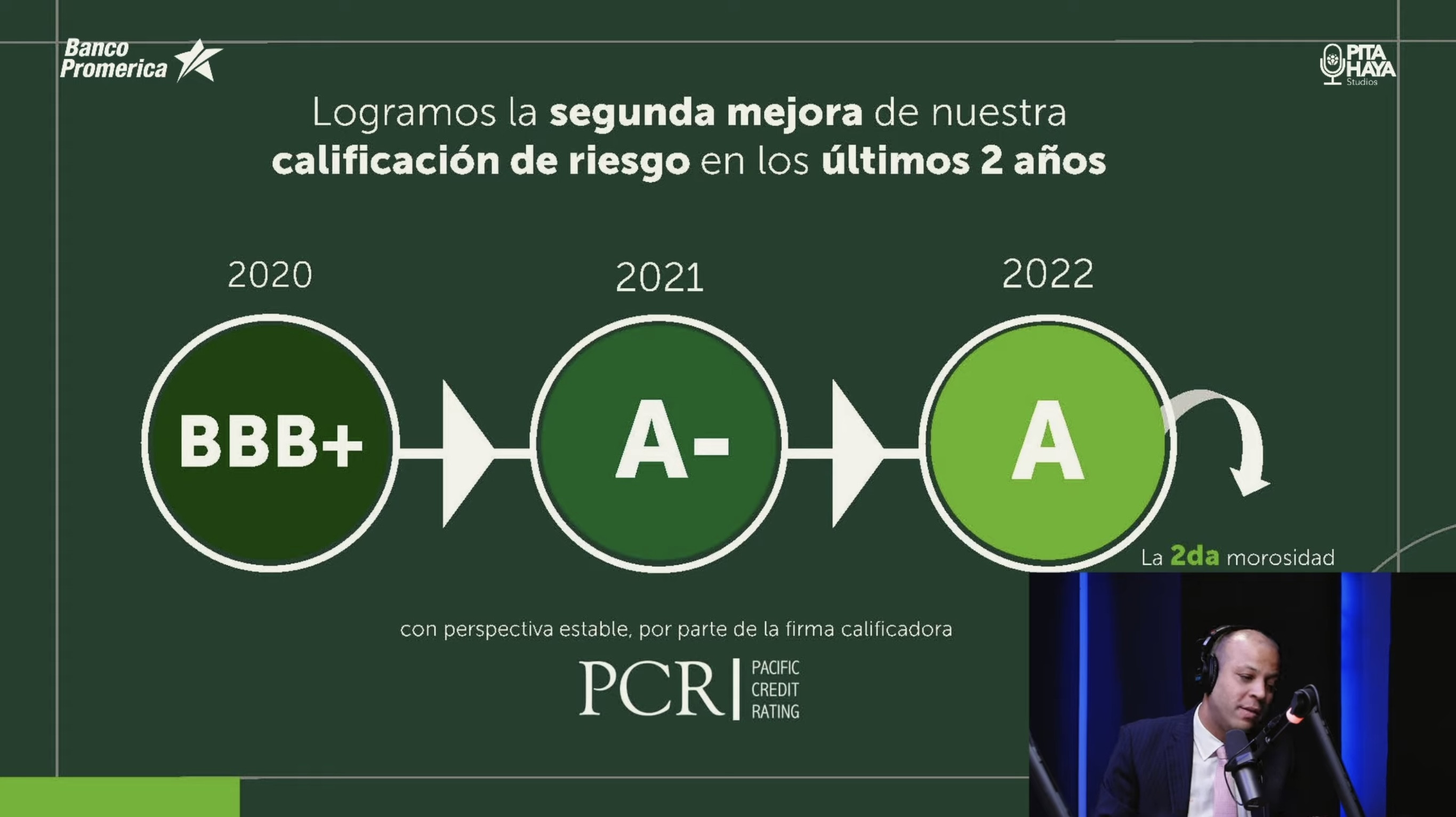

Their credit rating has improved as well from 2020 to 2022.